We know that balancing the cost and value of corporate health plans is currently one of the top priorities...

Horiens promotes insurance and corporate risk management course

DATE: 12/07/2023

Online event, aimed at finance executives who are members of IBEF-SP, addressed the importance of risk transfer to improve business performance

On November 21 and 28, Horiens held the online course “Insurance and Corporate Risk Management”, aimed at finance executives who are members of IBEF-SP (Brazilian Institute of Finance Executives of São Paulo).

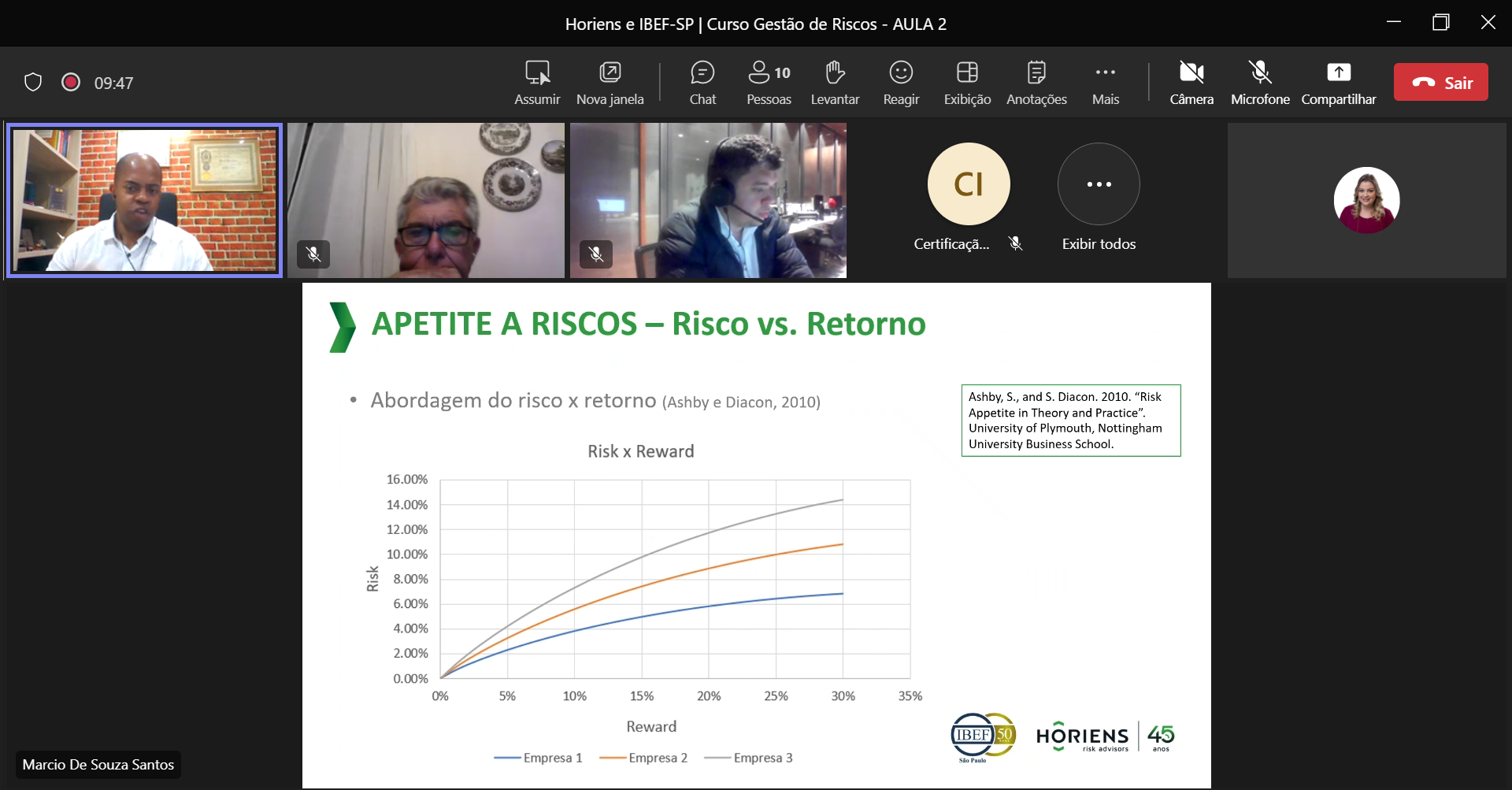

Taught by Marcio Santos, head of Horiens’ risk analysis laboratory, Risk Labs, the two meetings aimed to show participants how to improve the process of analyzing risks and transferring them via insurance. “Business insurance programs often don’t reflect the company’s risk profile, but they are essential tools in the business strategy. It is necessary to carry out a careful risk analysis and size the insurance correctly, making it possible to replace possible business losses at a competitive cost,” explained Santos.

Eduardo Damião, Risk and Insurance Director at Horiens, gave an opening speech in which he spoke about the diversity of risks and the importance of identifying them for possible transfer. “There are risks of the most diverse nature – commercial, environmental, operational, natural, legal, liquidity, among many others. We learn and visualize risks dynamically. Everything changes, business and society change, so the risks change too,” he warned.

Damião spoke of the importance of information when taking out insurance. “The inspection reports for a given risk are the first point of attention. They can be made by insurers, reinsurers or the client themselves. It is important to validate the activities reported, check the loss scenarios identified, establish a dialog about the recommendations presented and always take into account the lessons learned and mitigation actions in the loss history,” he added.

Márcio then mentioned the risk management cycle and the importance of a quantitative approach. “All the instruments for transferring and sharing risks, from the traditional ones to alternative instruments such as mutuals, captives, risk swaps, derivatives, etc., can only be established in an optimized way if we quantify the risks.”

Márcio explained that Horiens is a consultancy that has been working in the risk and insurance sector for 45 years and, more recently, has developed the use of quantitative methodologies to support risk transfer and retention decisions, whether based on data – frequency analysis – or probabilistic modeling of engineering models. “This is a sure way to increase availability and improve the performance of your companies through risk transfer.”

Among the topics covered in the course are: insurance in the context of corporate and project risk management, concepts of appetite/tolerance and their relationship to risk treatment, quantification of risks to optimize transfer and Quantitative Risk Analysis (QRA) x random uncertainties and knowledge uncertainties.

This year, Horiens became a partner of IBEF-SP, one of the most traditional organizations for executives in the financial sector. Founded in 1973, IBEF-SP has more than a thousand members and more than 300 CFOs, and has been working continuously to foster knowledge and create connections between market professionals.

The recording of the classes is available on the IBEF-SP platform for members (https://ibefsp.com.br/cursos-ibef-sp/). If you would like to learn more about the subject, the Horiens team is available to discuss it further.

No comments