We know that balancing the cost and value of corporate health plans is currently one of the top priorities...

Horiens at the XXI Meeting of the ABGR Electricity Sector Committee

DATE: 07/13/2023

In early July, professionals from the Brazilian energy sector gathered for the XXI Meeting of the Electric Sector Committee of ABGR (Brazilian Association of Risk Management). The traditional event brings together dozens of generation, transmission, distribution, commercialization and energy business companies to discuss risk management in the sector.

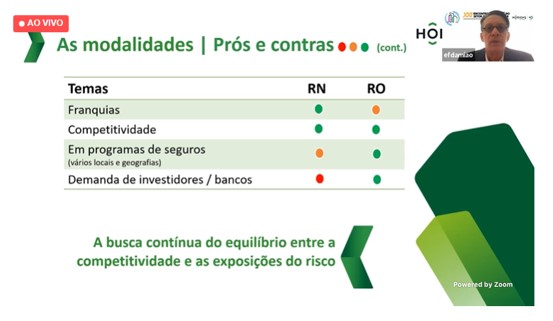

Eduardo Felix Damião, director of risk and insurance at Horiens, was the speaker of one of the panels of the event “What is the best modality to protect your assets?” In his presentation, Damião brought a comparison of two types of property insurance: Operational Risks (OR) and Named Risks (NR).

Operational Risk Insurance, also known as ‘All Risks’, is suitable for comprehensive coverage, with excluded risks identified in the policy. The Named Risk Insurance is indicated for the protection of specific risks, named in the policy. “Deciding on the best course of action requires a careful and personalized analysis of each company’s scenario. That’s why I wanted to bring to this panel a practical approach, with the pros and cons of each insurance”, explained Damião.

Before addressing the differences between insurances, Damião pointed out that, for any modality, there are fundamental points to be considered to ensure a good risk transfer process. “Understanding the quality of the risk, what the value at risk is and the loss limit makes all the difference. Always remembering that, in a renewal process, time must be an ally of the insured”, he explained.

In his analysis, Damião also highlighted that the continuous search for a balance between competitiveness and risk exposures should guide the risk manager’s mission. “Competitiveness is not only about the cost of insurance, but also about the deductible and the policy wording, for example. No one wants losses to occur, but if they do, the policy wording and coverage should meet the needs of the company. Surprise is something that should not exist in a good risk management process,” he concluded.

The meeting’s lectures are available on the event’s website. Click here and register to know the comparative analysis of Operational Risk Insurance and Named Risk Insurance*, among other panels carried out!

*The panel took place on July 5 and the topic can be found around 1 hour and 20 minutes into the recording.

No comments