Created in 2014, White January is a global movement that invites society to look more closely at mental health....

Support in decisive moments: get to know Optional Insurance

DATE: 08/04/2022

What was supposed to be just routine care turned into a turning point in Helena’s* life. After a complete health check-up, she was diagnosed with cancer and, with this diagnosis came a new routine of doctor’s appointments, exams, treatments, medications, and, consequently, new costs that were not foreseen. Then Helena remembered that she had taken out optional insurance at Horiens, which guaranteed coverage in case of Critical Illness. She filed a claim and quickly received compensation, which was essential for her to pay for part of her treatment.

Humberto’s* situation was a little different. He suffered a serious accident at work and was rushed to the hospital, where he underwent several surgeries. With his physical condition compromised after the accident, Humberto needed a lot of care, and the compensation he received for the Accident Disability coverage that guaranteed support in such a delicate moment.

The adoption of a preventive strategy in relation to situations that get out of control was a decisive attitude for both Helena and Humberto. By contracting the Optional Insurance, they were not only guaranteeing a differentiated coverage with attractive values, but also a greater peace of mind to face the challenges that would rise in their lives.

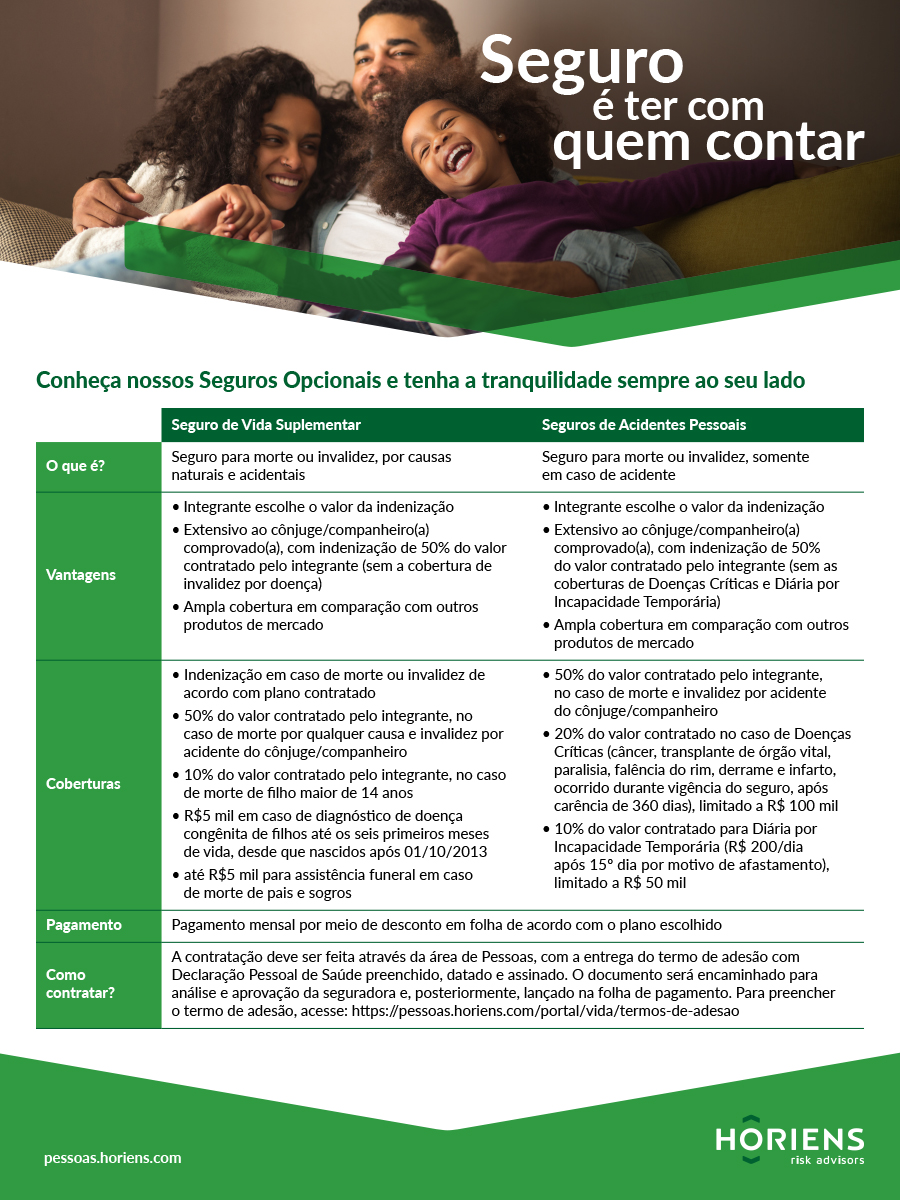

“The optional insurances have differentiated coverage and the member can count on expressive indemnities paying very little per month, which is a great differential in relation to the products that exist in the market”, states Verena Sá, responsible for Life Insurance at Horiens. You can hire it at any time. Get to know some of the advantages and coverage of the optional insurances, and learn how to contract them – only in portuguese:

No comments