Vexty ended the year 2025 with a special reason to celebrate! The company achieved the Self-Regulation Seal in Investment...

January 2021 Market summary and 2022 expectations

DATE: 02/10/2022

The 2021 financial market and 2022 expectations

In another very challenging year for investment managers around the world, with the persistence of the Covid-19 epidemic and its unfolding effects on the economic environment, the central variable to briefly understand the dynamics of investment results in 2021 are continued caution to risk exposure and the consequent migration of capital from emerging markets to developed markets, especially to what is considered the safe haven for global investors, the U.S. market.

In addition, we have observed a very troubled political-economic environment internally, with a scenario of polarized elections approaching, which discourages international investors from returning to allocate resources in the country. Until the situation is clearer, at least.

Finally, but not least, the Chinese real estate market crisis with the imminent bankruptcy of one of its largest local construction companies, has put a warning sign about a possible systemic crisis and contamination of other markets.

In summary, these were the main events of the year, however, it should be noted that, obviously, there are countless variables that affect investments and the purpose of this text is to enlist only a few factors that can explain the investments environment, without being exhaustive.

Even with the interest rates on US treasury bonds paying their holders with negative effective returns (nominal interest rate below inflation), in times of risk aversion and volatility of investors, these funds end up being redirected to this market, as the US currency and government bonds are considered the lowest risk assets in the global financial market. And what we have observed in 2021 was a continuation of this movement, with less strength, but with some constancy.

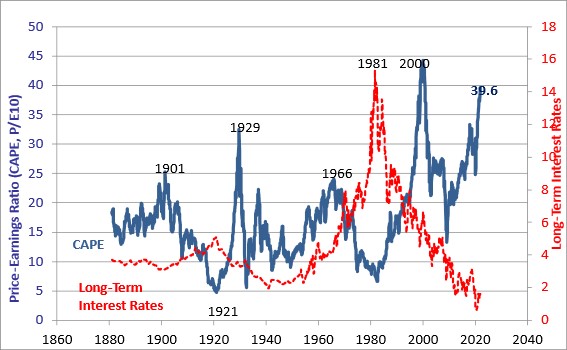

Even though the US stock market has reached its all-time highs, the shares of listed companies continued to attract investors in an environment of extremely low interest rates. We can see from the graph below, using the CAPE-Shiller index, that the multiple of stock price in relation to companies’ earnings (adjusted for inflation) is at extremely high levels. In other words, the American stock market would be relatively “expensive” since it is trading above its historical standard.

CAPE index on the left | Long Term Interest Rate of the US Treasury on the right

Source: http://www.econ.yale.edu/~shiller/data.htm

A similar performance has occurred in developed markets as a whole, but not in emerging markets. The MSCI World, index representing stocks exclusively in developed markets, increased 30.6% in Reais and 21.82% in Dollars in 2021. While the MSCI Emerging Markets, index representing emerging markets, showed in the same period, an increase of 4.51% in Reais, but a decreased all of 2.54% in Dollars.

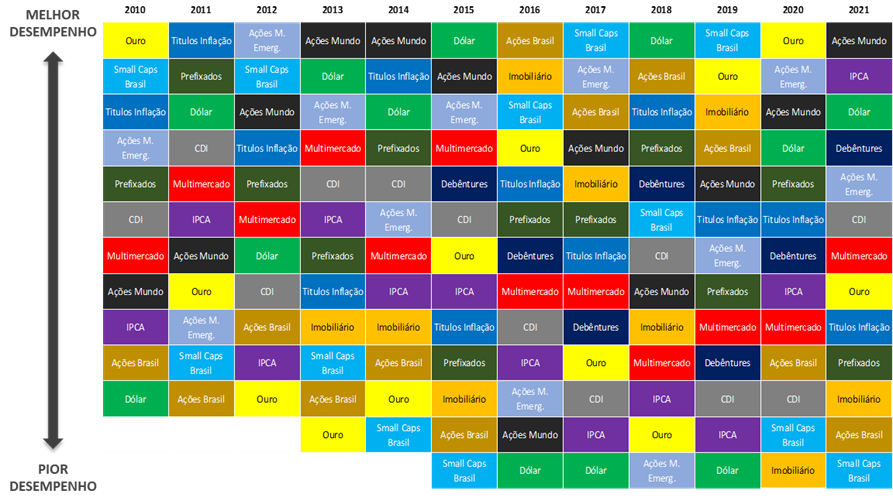

Thus, the segment we call “World Shares” showed last year the best performance in relation to the segments we follow, and which is summarized in the table below.

Source: Vexty’s Investment Management Report

We periodically map the performance of 12 types of potential investment segments, we rank each investment from most profitable to least profitable in each year, and indicate the IPCA variation index of the respective years. The definitions can be seen at the end of the article.

With an increase of nearly 19% in Dollars (USD) and driven by the currency’s appreciation of more than 7%, World Stocks has a performance of 27.1%. In fact, being the only one in this list to exceed the IPCA in 2021.

On the other hand, as we highlighted in the article “Investment Performance in 2021”, Brazil Stocks (represented by Ibovespa), was relatively one of the worst investments among those mapped, with a decrease of 11.9% in 2021.

In the table above, it is also possible to observe that the IPCA not only figured at the top of the segments, but was higher than the CDI itself in the period, indicating that the Real Interest Rate (nominal rate deducting inflation) in Brazil was negative in 2021 (just as it has occurred in 2020). This situation observed in these two years was quite atypical and, in a way, unprecedented in the recent past here in Brazil.

Finally, still on the chart above, we would like to reinforce the message we try to convey to Participants and Assisted, about the importance of having a diversified portfolio, as it turns out to be the best way to mitigate the volatile behavior of all markets. See that every year, the ranking of the best and worst investments changes a lot. Trying to guess which will be the best investment in the period, looking especially at past behavior, may not be the best decision.

That’s why here at Vexty, within the macro strategy we follow, diversification of portfolio of the assets invested within each Profile is one of the key points.

Market Expectations for 2022

Looking ahead, when we look at the S&P futures contract quote -one of the U.S. stock market indexes- we can speculate that the market is not expecting a thriving stock market high in 2022. With the index at 4,659.03 points on 01/13/21 and the Dec/22 futures contact at 4,685.00 – source https://www.marketwatch.com/-, the expected high is assumed to be less than 1%. This calculation does not take into account several other factors, and it is not an investment indication.

Meanwhile, IPCA reached its highest since 2015. With an increase of 10.06%. Several factors contributed to the sharp rise shown in the prices measured by the index, but the main explanation comes from the difficulty of companies in keeping production chains operating normally, generating shortages of important products and, consequently, impacting the level of prices charged. Regarding market expectations for inflation in 2022, the agents consulted by Bacen expect the IPCA to end the year near 5.09% (Focus Report of the Central Bank of 01/14/2022), above the center target established by the CMN of 3.5% for 2022.

Inflation weakening is expected in a recessive economic environment and, simultaneously, by the normalization of the government’s monetary policy with a strong increase in the economy’s basic interest rates, after an unprecedented period of the lowest rates in the history of the Brazilian economy. 2021 started with the Selic rate or CDI close to 2.00% and ended the period with rates at 9.25% per year, presenting an accumulated rate at the end of the year of 4.40%. Data from the BIS (Bank for International Settlements) shows that the pace of increase in Brazilian interest rates was the highest among all rates analyzed (32 central banks) and Brazil is among the three economies with the highest inflation in the accumulated over 12 months, behind Argentina (52%) and Turkey (19.9%).

When we take into account the expectation of inflation and interest rates in 2022, the country has also returned to lead the ranking of real interest rates, passing Russia and Turkey. With an average rate of 11.75% and expected inflation at 5% for the year, the real interest rate will be close to 6%. Remember that in 2020 and 2021 the real interest rate was negative in Brazil, as we indicated above.

Finally, looking at the Brazilian variable income market, we find the last positions in our ranking. With a recessive economic environment, political uncertainty, and tightening of monetary policy, investors have left the Brazilian stock market, especially international investors. Thus, the Ibovespa ended 2021 with a drop of 11.9% and the Small Caps share index, companies with lower market capitalization (between R$300 million and R$2 billion), dropped by 16.2%.

Since companies’ valuation models use the future interest rate in the valuation process (the discount rate for Valuation) and profitability projections are taken over the very long term, corporate stocks are very sensitive to changes in interest rates. Due to this tendency of anticipation of future events by the financial market, we can understand that a large part of the risks arising from the economic environment described in this text can be contained presently in the assets prices. In other words, the market does not wait for the calendar year to move. Every day, expectations of future events are incorporated into asset prices.

Given that there is a perception of high risk, assets are being traded below historical standards, from various analysis points of view, and this is very noticeable in the case of the Brazilian stock market. Taking into account the profitability estimates of the companies that make up the Ibovespa, for the next 12 months it is expected that the average of the ratio between the stock prices and their respective annual profits will be traded at a multiple of 10 times.

When we look at the past, we see that the historical trading pattern of the Brazilian stock market is a ratio of 14 times the companies’ profits. This indicator alone is not sufficient for conclusions, but it is a relevant indicator of how discounted the Brazilian stock market may be in relation to its trading pattern. For comparison reasons, the American stock market trades at multiples above 30. If no epidemiological catastrophe occurs, if interest rates do not go beyond their current levels, and if there is an improvement in the political-institutional environment, it is expected that the stock market will return to its historical trading patterns. The doubts from a good part of the market end up being: what will be the pace of adjustment? Sooner or later? Before or after this year’s elections?

To learn more about the investments governance here at Vexty and how we seek through an efficient and safe management of the assets of the Plan we manage, just access our various communication and information channels.

Indicators:

– CDI: Pursuant to the CDI (Interbank Deposit Certificate). Reference interest rate for financial transactions (mainly short term).

– Inflation-indexed securities: Pursuant to IMA-B. Index calculated by Anbima, reflecting the performance of Government Bonds linked to the IPCA, regardless of maturity.

– Prefixed: Pursuant to IRF-M. Index calculated by Anbima, composed of prefixed government bonds, which are the LTNs (National Treasury Bills or Fixed-rate Treasury bonds) and NTN-Fs (National Treasury Notes – Series F or Fixed-rate Treasury bonds with Semi-annual Interest).

– Multimarket: Pursuant to IFMM-A. Index calculated by BTG bank, measuring the behavior of the Multimarket Investment Funds in Brazil.

– Brazil Stocks: Pursuant to IBOV (Ibovespa). Index calculated by B3, measuring the performance of the companies’ shares with high trading volume in the official Brazilian Stock Exchange

– SmallCaps BraSil: Pursuant to SMLL. Index calculated by B3, measuring the average performance of asset prices of a portfolio composed of the smallest capitalization companies traded on the official Brazilian Stock Exchange

– World Stocks: Pursuant to MSCI ACWI. Index calculated by Morgan Stanley, measuring the performance of stocks in developed and emerging markets.

– Stocks Emerging Markets: Pursuant to MSCI EM. Index calculated by Morgan Stanley, measuring the performance of stocks in emerging markets.

– Debentures: Pursuant to IDA General. Index calculated by Anbima, which mirrors the behavior of a private debt portfolio, more specifically debentures.

– Dollar: According to the US Dollar variation (purchase)

– Gold: Pursuant to iShares S&P/TSX Global Gold Index

– Real Estate: Pursuant to IFIX. Index calculated by B3, reflecting the average performance of the real estate funds traded on B3’s exchange and organized over-the-counter markets.

– IPCA: Pursuant to the Broad Consumer Price Index calculated by the IBGE

Always be up-to-date about the performance of your investments. Vexty. Absolutely.

No comments