Find out about the main actions carried out during 2024, the results achieved and the strategic initiatives for Vexty’s...

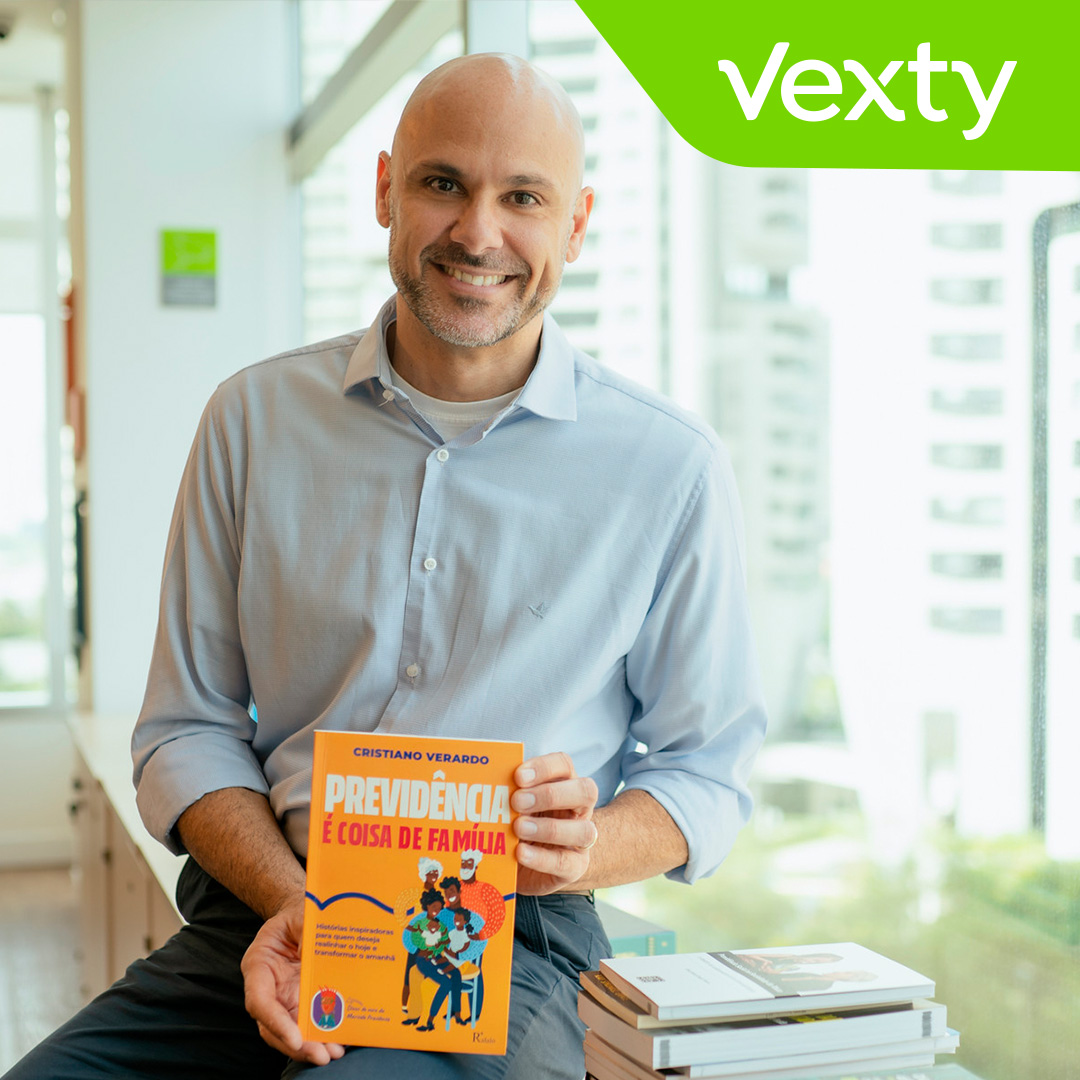

Vexty´s Director launches book about financial and pension education

DATE: 05/05/2025

With a solid track record in the sector, Vexty’s Director of Security, Relations and Technology, Cristiano Verardo, has shared his practical experience, accumulated over the years at the Entity, in the book “Social Security is a family affair – Inspiring stories for those who want to realign today and transform tomorrow”. The book, which had the collaboration of Abrapp, brings an accessible and humanized approach to financial and pension planning, bringing together real and inspiring stories that show how conscious decisions in the present can positively impact the future, and seeks to demonstrate that pension planning goes far beyond numbers: it is an instrument for social and family transformation.

“At Vexty, our mission is to provide security and quality of life for our Participants. The publication reflects our years-long quest to foster dialog about the importance of financial education,” explains Cristiano.

For Vexty’s president, Mauro Figueira, the book reinforces the Entity’s values. “Cristiano Verardo’s initiative is totally in line with the way we think about pension plans at Vexty, as an instrument of education, planning and transformation in the lives of people and their families,” added Mauro.

Find out more details and curiosities about Pensions is a Family Thing in the exclusive interview with Cristiano Verardo!

Why a book suggesting that “Social Security is a Family Thing”?

Firstly, because there hasn’t been an educational tool like this before, at least not here in Brazil! We were blessed with this window of opportunity and we made the most of it, eternalizing much of the knowledge that Marisele Previdente (who makes the “spirit” of our supplementary pension plan tangible) teaches us about Prevident Attitudes.

Secondly, I continue to respond with a provocation, which is little talked about out there, which is: the greatest enemy of a dignified retirement is usually one’s own family, and the one who suffers most from the impacts of this is also one’s own family.

I believe and promote the idea that, contrary to popular belief, any effort to provide a dignified retirement is a family act, never an individual one.

I’ve been following this issue for a long time. I know the bleak future that awaits those families who put off “planning for retirement” until later. These are the same families that will suffer the devastating impacts of a bad – or non-existent – planning.

A poorly planned future impacts an entire family, practically, emotionally and financially.

And if that’s the damage, taking action on social security should be a priority for everyone in the household, not least because it needs to start being planned and built much, much earlier than you might think.

And it’s not a question of “putting everyone in a family in the same boat”, but of getting them to “row in the same direction” and the book “Social Security is a Family Thing” is an important instrument for inviting reflection, awakening and change about the future of many Brazilian families, especially because this educational tool will help us to “burst the bubble” where we work professionally and to “open even more doors and windows” between the Brazilian supplementary pension segment and the people who “are on the other side”, without access to the important information we have with us about their future.

Why do you talk about “bursting the bubble” or “opening doors and windows”?

Me and thousands of other professionals work in the Brazilian supplementary pension segment, whether in Closed Entities (those that operate pension solutions for specific groups, such as a company’s employees), Open Supplementary Pension Entities (those that even make their plans available to anyone) or in the other organizations that are part of this segment.

I consider this professional space to be “our bubble” or “our fortress”. In here, since we “breathe” the problem of families’ lack of pension planning on a daily basis, mainly due to the scarcity of financial education, we know everything that people can and should do.

The thing is, we have our difficulties communicating with people “on the outside”, either because we’re too busy executing all of the Entity’s complex processes with the utmost competence and care (good thing, after all, we take care of our participants’ and beneficiaries’ money), or because we wouldn’t be able to adequately reach the “hearts and minds of thousands or millions” with the speed that the current scenario demands, or because our (very technical) communication skills can’t get the interest of those who need to hear our message!

That’s why we need to “burst our bubble” or “open even more doors and windows” between us and those who really need to hear our warnings and our proposals for solutions, and a book like “Previdência é Coisa de Família” has great potential for this, as it “speaks” to people of any age and any level of knowledge on the subject of pensions or planning for a dignified retirement.

Who was this book written for? Who was its target audience?

In the last chapter of the book, I confess that I wrote “Pension is a Family Thing” for “four types of people”. They are: (1) young people (between the ages of fourteen and seventeen, “a little less or a little more”), (2) mothers, fathers or those responsible for “small and medium-sized people”, (3) educators in general, acting formally (as a teacher) or informally in this noble task, and my colleagues on the mission, the (4) professionals, leaders or directors of Closed (or Open) Supplementary Pension Entities, for example.

It’s almost a book “for everyone who breathes”.

There is a specific objective for each of these groups.

The Provident Attitude provocations contained in the book’s stories will help greatly in the process of reflection, awakening individual and family changes.

What can these readers expect by exposing themselves to the contents of “Social Security is a Family Thing”?

The Welfare Attitudes set out in this book not only help the individual or the family group to build a Welfare Plan (Welfare Plan with the “p’s” in capital letters, which the reader will understand as they leaf through the pages), but also make an incredible contribution to a more balanced and prosperous daily life. In the pages of the book, the reader will see themselves, question themselves, be moved, be invited to reflect, to change and, finally, be provoked to:

1) Invite the Wise Attitude to become part of your life and the life of your family, as a new attitude to transform the present and the future;

2) Implement strategies and actions to involve everyone in the household in building a family future plan, aligning the efforts of all generations;

3) Getting everyone to “row in the same direction”, towards the same destination, because it’s not enough to “be in the same boat”, but it is necessary for everyone to “row in the same direction and submit to the guidance of the captain of the vessel”!

4) Recognize the challenges of the current retirement scenario and lead yourself and your family towards a more secure tomorrow; and

5) Avoiding the risks of an unwanted end of life, using strategies that protect everyone around them (of course, depending on what each reader does with the content made available in the pages of the book).

I know that a possible change starts here. But, of course, reading and letting yourself be influenced is a decision that needs to be made by the reader and their entire family, preferably as soon as possible, exposing themselves with an open heart and mind to the carefully selected Wise Attitudes provided in each of the stories!

I know that a dignified retirement doesn’t happen by chance. I see it happen every day in my work at Vexty.

Retirement which, by the way, has nothing to do with the pejorative term “hanging up the boots”, which has nothing to do with “stopping producing, contributing and setting yourself apart from society”.

I believe in a dynamic and contributory retirement, as a result of choices made and decisions taken yesterday and today.

Retirement is a family project and an important first step starts with “Retirement is a Family Thing”, you bet!

What is a Welfare Attitude, which you talk about so much?

An attitude is basically a behavior, a way of acting or reacting, planned or unplanned, but motivated by an inner disposition, by an individual’s will. Attitude is also a way in which a person chooses to behave in certain situations. Everyone has an attitude. Now, a Foresighted Attitude is all of these things, but with the intention of anticipating future problems, preventing them, predicting the future (as far as possible) and taking precautions. It’s the opposite of a negligent attitude, for example. In the book I use a proverb that sums up these two attitudes well. It goes like this: “The prudent foresee the danger and take precautions; the naïve proceed blindly and suffer the consequences.” My invitation with “Social Security is a Family Thing” is to be prudent, and not only that, but also to take effective precautions, especially with regard to the future! Life demands it!

What is your dream for the book?

Oh, my dream for this book is very clear! I wrote all this thinking about these things.

And my dream has to do with those “four types of people” to whom I directed everything I wrote.

My dream for young people is that, after reading this, they will help their parents or those who currently look after them more, understanding that these people are struggling to work, pay the bills, buy what they need, fulfill some dreams, etc. and that they need help, even if they don’t explicitly ask for it. That children help their parents by acting like “someone on the same team”, playing together, being more economical, wiser, more careful with money, in other words, young people with a Foresight Attitude, involved in building their parents’ or guardians’ retirement phase, knowing that this is good for them too.

My dream for fathers, mothers or guardians reading this content is that they take on the role of captain of the “ship” that will take them (everyone in the house) to the destination of a dignified retirement and that they lead relevant changes in their behavior and in their homes. Let them read the stories in this book to their children and discuss with them how to apply the Wise Attitudes in their family’s daily life!

With regard to educators (those by profession and those by vocation), my dream is that this group will invite their students and their “teachable hearts” to also reflect on the Wise Attitudes presented in the stories in “Social Security is a Family Thing”. May they help us spread financial and pension education with the aim of influencing generations!

How specifically can EFPCs get involved with this “movement” provoked by “Previdência é Coisa de Família”?

Oh, both an EFPC and an EAPC, as well as all the businesses, consultancies, investment houses etc. that are part of our industry, can get very involved! I have a few suggestions myself. For example:

1) Getting this material into the hands of those responsible for financial education, marketing or communications. Encouraging them to get involved in the stories, in order to try to extract from them the wisdom needed from the Welfare Attitude to help participants (and even beneficiaries) correct their course, realigning today to achieve a better future.

2) Promoting and encouraging reading groups with participants, especially younger ones, to discuss certain chapters, making the most of every “drop” of the Welfare Attitude recorded here.

3) Investing in special print runs (I don’t know, to commemorate the Entity’s anniversary or as part of ENEF Week) to be donated to families, social projects or schools in the region, for example, expanding your organization’s power of influence.

4) Promoting lectures, conversation circles or financial (and social security) education actions based on the knowledge offered by the book. I wonder how many families would be impacted by a simple act like this.

5) Introducing Marisele and Foresighted Attitude to your audience of influence! EFPC staff know that people (even those who already have a pension plan) need to be awakened urgently. Marisele knows how to talk to them! Get her on your organization’s education team!

6) Finally, gifting and blessing your friends, children and family with all this wisdom from Foresighted Attitude, carefully selected and lovingly packaged in this book. Marisele and I also agree that, often, “saints don’t work miracles” and that’s why the book is such a good support tool!

In short, get involved in this movement in any way you can!

Any super highlights from the book?

No. Yes. Wait…! On page 29, within the chapter “rotten eggs are stinking”, there is a dramatic moment in which Marisele reveals her anguish as an educator, influencer and “awakener”, suggesting “that someone needs to break the bad news to people about the difficulties they will inherit from themselves when they reach retirement! And pay attention to this: that they will inherit from themselves!” That’s it. There is bad news that needs to be broken. There is a future that people are building for themselves and that they will inherit this (dark, most of the time) future from themselves. We don’t like giving or receiving bad news, but the fact is that it’s this kind of message that allows us to change! As long as we are sparing or being spared the truth, we run a serious risk. Marisele and I, in “Social Security is a Family Thing”, have taken the courage to say things that may even be upsetting at first, that “really get to the bottom of things”, but which will ultimately offer a path to change.

What is the involvement of Abrapp and UniAbrapp in this “movement”?

Although the book was produced independently, the involvement of Abrapp and UniAbrapp is huge and fundamental! The association and the university took on the role of cultural and institutional supporters of the book, seeing its validity as a vehicle for disseminating social security culture “outside our bubble” or “beyond our walls”. Without the support and encouragement of Abrapp and UniAbrapp, none of this could happen!

For those who don’t know, who is the now “writer” Cristiano Verardo?

Well, “he” is absolutely nobody special!

He knows that I was just another ordinary Brazilian, going about my daily life without any worries about retirement. That was about 15, 20 years ago.

Until I started working in the Brazilian private pension sector, at Vexty.

I know that it didn’t take long for me to realize what a problem neglecting this issue would be for me, my wife Milena and our daughters Rafa, Lorena and Laura, and I quickly began to adjust my attitudes and take on a more leading role in this movement.

That’s how I discovered yet another reason to live: to present Foresighted Attitudeto everyone, from 12 to 90, 100 years old, in order to help families implement behaviors and attitudes that will contribute (a lot) to building a safer tomorrow.

And with a very light-hearted, very “real life” approach, I’ve been helping people to wake up to the need to live in the present with an eye on the future, involving everyone in the house through the Foresight Attitude.

I’m also the promoter of the concept Foresighted Attitude ,, the creator of the character Marisele Previdente, Milena’s husband of over twenty years, father of Rafaela and twins Lorena and Laura, an executive in the supplementary pension segment at Vexty (a pension plan administrator for large companies such as Braskem, Atvos, Ocyan, Novonor, DP World, Foresea, OEC and Itaguaí Construções Navais, among others), a teacher and supporter of various educational initiatives by the Brazilian Private Pension Association (Abrapp), a spokesperson for the “Pension is a Young Person’s Thing” initiatives and now also the author of the book “Pension is a Family Thing”.

How can I get the book?

The book can be found on the main online shopping platforms, such as Mercado Livre (https://produto.mercadolivre.com.br/MLB-5336637054-livro-previdncia-e-coisa-de-familia-_JM) and Bookwire (https://bwlnk.com/9786598592011). For companies or promotional activities, editora@ralalo.com.br.

No comments